|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

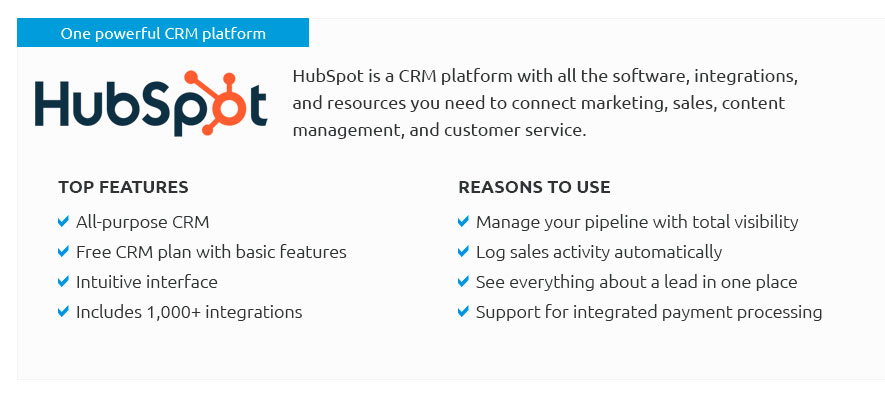

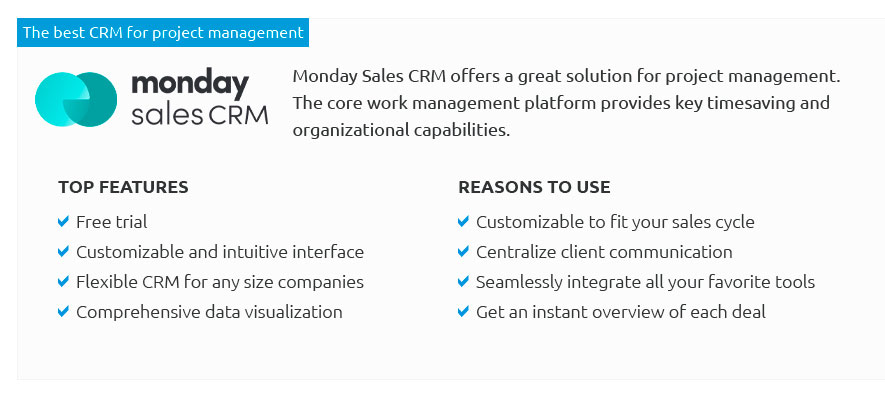

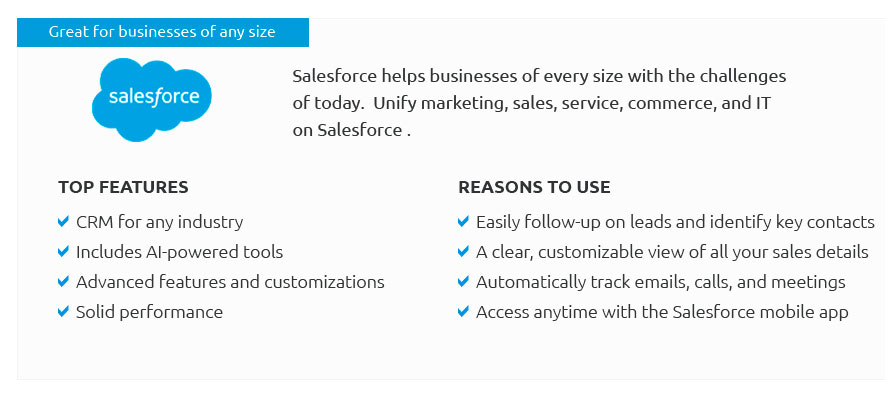

Best CRM for Insurance Brokers: A Comprehensive OverviewIn the fast-paced world of insurance brokerage, finding the right Customer Relationship Management (CRM) system can be the difference between thriving and merely surviving. As an insurance broker, your role demands meticulous organization, robust client interaction, and efficient data management. This is where a CRM system becomes an invaluable asset. But with the myriad of options available, how do you choose the best CRM tailored to the unique needs of insurance brokers? To start, let’s consider what makes a CRM system stand out in the context of insurance. First and foremost, customization is key. Every brokerage has distinct workflows and client interaction models. A CRM that offers customizable features allows brokers to tailor the system to mirror their specific processes, thereby enhancing productivity. Many of the top CRM systems offer customizable dashboards, personalized reporting, and tailored communication tools, which are essential for brokers who need to keep track of policy renewals, claims, and client interactions seamlessly. Integration capabilities are another critical factor. A CRM that seamlessly integrates with other essential tools, such as email marketing platforms, document management systems, and accounting software, can significantly streamline operations. This level of integration not only saves time but also reduces the risk of errors that can occur when data is transferred manually between systems. Among the top contenders in the CRM space for insurance brokers is Salesforce. Known for its robust customization options and powerful integration capabilities, Salesforce is often praised for its ability to adapt to various industries, including insurance. Its cloud-based platform ensures that brokers can access client data and interact with their teams from anywhere, providing the flexibility needed in today’s dynamic work environments. Another noteworthy mention is HubSpot CRM, which offers a free version that is particularly appealing for smaller brokerages or independent agents. HubSpot’s intuitive user interface and strong emphasis on inbound marketing make it an excellent choice for brokers looking to enhance their marketing efforts while maintaining a comprehensive overview of client interactions. For those who prioritize ease of use and a more straightforward implementation process, Zoho CRM might be the perfect fit. Zoho CRM is lauded for its user-friendly interface and affordability, providing a solid choice for brokers who may not require the extensive customization that larger systems offer but still need a reliable platform to manage client relationships effectively. AgencyBloc deserves special mention as a CRM specifically designed for the insurance industry. With features like automated workflow management and detailed policy tracking, AgencyBloc caters directly to the needs of insurance brokers, offering tools that help manage the client lifecycle from lead to policy renewal efficiently. When choosing a CRM, it’s crucial to consider customer support and training options offered by the provider. A system that offers comprehensive training resources and responsive support can significantly ease the transition for brokers and their teams, ensuring that they can make the most of the CRM’s features without a steep learning curve. In conclusion, the best CRM for insurance brokers hinges on the specific needs and size of your brokerage. Whether you prioritize customization, integration, ease of use, or industry-specific features, there’s a CRM out there that can meet your requirements. Taking the time to evaluate these aspects carefully will undoubtedly pay off in the long run, enhancing both your operational efficiency and client satisfaction. https://www.insightly.com/industry/crm-for-insurance/

An insurance CRM helps agencies streamline sales processes, improve profitability, and create long-term customer relationships. https://www.findmycrm.com/industries/crm-for-insurance

Best Insurance CRM - agencybloc-original-1. AgencyBloc was created to make the lives of insurance agents easier. - insly_mainHQ. Insly is a cloud-based CRM, ... https://www.lessannoyingcrm.com/industry/insurance-agent

Designed with the independent agent in mind, Less Annoying CRM is the easiest system to track policy applications, store group plan information, and stay on top ...

|